At Haqqex, we believe in providing our users with the tools they need to trade responsibly and with confidence. That's why we offer a variety of order types, including the "Stop-Limit" order. This powerful tool can help you manage risk and execute trades with greater precision, aligning with the principles of careful and ethical investing.

What is a Stop-Limit Order?

A Stop-Limit order is a type of order that combines the features of a "stop" order and a "limit" order.

It allows you to set two price levels:

- Stop Price: This is the price at which the order becomes active.

- Limit Price: This is the specific price at which your order to buy or sell will be placed.

Think of it as a two-step process:

- Trigger: When the market price reaches your stop price, it triggers your order.

- Execution: Once triggered, a limit order is placed at your specified limit price.

How It Works on Haqqex :

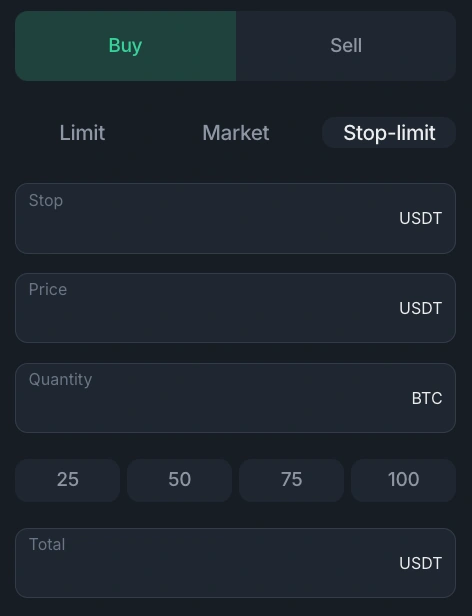

Let's look at the screenshot from the Haqqex trading interface. You'll see these fields:

- Stop (USDT): Here, you enter the price at which you want your order to be activated. In the example, it's shown in USDT.

- Price (USDT): This is where you set the limit price – the exact price you're willing to buy or sell at. Again, it's in USDT.

- Quantity (BTC): You specify how much of the asset you want to trade (in this case, Bitcoin - BTC).

- 25 50 75 100: These buttons likely represent percentage shortcuts, allowing you to quickly select 25%, 50%, 75%, or 100% of your available balance.

- Total (USDT): This shows the estimated total cost of your trade.

Example: Buying Bitcoin

Imagine you want to buy Bitcoin (BTC) but only if it starts to go up after reaching a certain price. You could set a Stop-Limit order like this:

- Stop (USDT): $79,000 (This is the price at which you want the order to become active).

- Price (USDT): $79,200 (This is the limit price you're willing to pay for BTC once the order is active).

- Quantity (BTC): 0.1 (This is how much BTC you want to buy).

Here's what happens:

- If the price of Bitcoin goes up to or above $79,000, your order is triggered.

- A limit order to buy 0.1 BTC at $79,200 is then placed on the exchange.

- Your order will only be filled if the market price reaches $79,200 or lower.

Why Use Stop-Limit Orders?

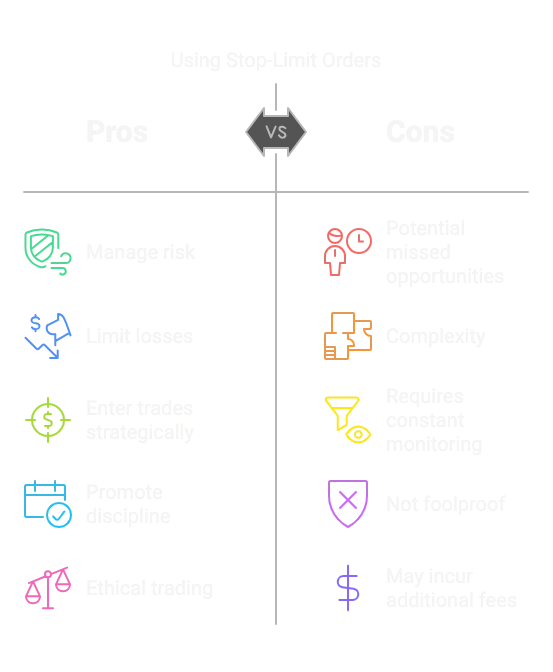

Stop-Limit orders are especially useful for:

- Managing Risk: You can limit potential losses. For example, if you own an asset, you can set a Stop-Limit order to sell it if the price drops to a certain level. This can help you protect your capital.

- Entering Trades at Specific Prices: You can use them to enter a trade only when the price reaches a level you consider favorable.

- Combining Strategy with Discipline: They help you stick to your trading plan and avoid impulsive decisions. This aligns with ethical trading principles, which emphasize rational decision-making.

Ethical Considerations

Using Stop-Limit orders responsibly is part of ethical trading. It's about:

- Informed Decisions: Understanding how they work and using them strategically.

- Risk Awareness: Recognizing the potential for losses and using tools to mitigate them.

- Avoiding Manipulation: Not using these orders to try to manipulate the market or take advantage of others.

Important Note:

While Stop-Limit orders offer control, they don't guarantee execution. If the market moves very quickly, your limit order might not get filled.

Haqqex and Responsible Trading

Haqqex is committed to providing a platform where users can trade with integrity. By understanding and using tools like Stop-Limit orders effectively, you can participate in the financial markets in a more informed and responsible way.

We encourage all our users to learn about different order types and develop their own trading strategies based on sound principles and a clear understanding of risk.